tax avoidance vs tax evasion hmrc

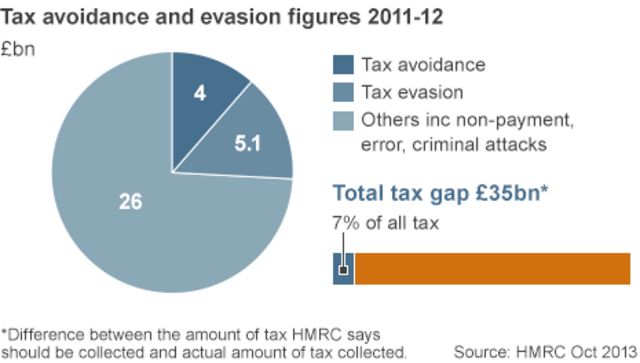

Even if a scheme is not mentioned it will still be challenged by HMRC. HMRC the UK tax assortment agency estimated that the general value of tax avoidance within the UK in was 17 billion of which zero7 billion was loss of income tax National Insurance contributions and Capital Gains Tax.

Say No To Premium Numbers That Begin With 0870 0845 0844 Etc Sayings Accounting Services Accounting

Tax avoidance involves bending the rules of the tax system to gain a tax advantage that parliament never intended.

. We are hitting tax avoidance and tax evasion harder than ever before. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. HMRC takes a very dim view of both tax avoidance and tax evasion but while one isnt illegal the.

HMRC have recently published a paper entitled Tackling Tax Avoidance Evasion and Non-Compliance which details over 100 measures. The difference between tax avoidance and tax evasion essentially comes down to legality. In recent years concerns as to the scale of mass marketed tax.

We have gathered examples from recent and historic high-profile cases to help you unpick the fine line. There could be some grey areas the place its troublesome to tell apart between avoidance and evasion. A post on Facebook falsely claims that more resources are devoted to combating benefit fraud than tax fraud.

It often involves contrived. Tax evasion means concealing income or information from the HMRC and its illegal. Contact the HMRC fraud hotline if you cannot use the online service.

The topic of tax evasion vs tax avoidance is popular amongst both tax payers and accountants but what is the difference between the two. Its not always easy to see where one ends and the other begins. In fact it was announced in the Spring Budget this year that HMRC has secured 140 billion in tax revenue from organisations and individuals who had been found to be using underhand tactics to avoid tax.

Tax evasion is a type of tax fraud whereby income or information is concealed from HMRC whereas tax avoidance is where individuals and businesses identify grey areas in tax laws and find ways of reducing taxable income or tax owed. There is a distinction to be drawn between tax avoidance and tax evasion. The difference between evasion and avoidance is down to legality and there is a very fine line between the two.

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. This could include deliberately submitting false tax returns falsely claiming. The estimated cost of tax avoidance is between 35 billion - 125 billion a.

Tax evasion and avoidance schemes are designed to reduce peoples tax bills and are both viewed negatively by HMRC. Uproar over Panama which was nothing to do with tax avoidanceevasion then no-one batting an eyelid at the. Tax evasion is illegal and describes a situation where someone acts to deliberately evade tax.

Those seeking to evade or avoid tax using offshore structures are of particular interest to HMRC with a consultation announced on the requirement to notify HMRC of such structures. To counter tax avoidance HMRC in Finance Act 2013 introduced the arrangement called General Anti-Abuse Rule. Tax evaders are bad for the economy and are generally sticking their fingers up at society.

1400 staff already investigate benefit fraud and another 2000 are being hired. Tax avoidance vs Tax evasion-Understanding the difference between both and having an accountant that knows the complexities of the UK tax system is really important. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law.

The estimated cost of benefit fraud is 23 billion a year. Other ways to report. Again the lines between tax avoidance and tax planning can also get blurred.

The tax evasion vs tax avoidance debate is a long-standing one. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. In fact HMRC you should be making tax clearer and simpler so that avoidance is easier and fairer for all.

Genuine mistakes on a tax return such as. The Government confirmed its commitment to tackling tax evasion and avoidance alongside aggressive tax planning and non-compliance. The core objective of GAAR is to account for the individuals and.

Crossing that line can lead to hefty fines and prosecution. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down on what it suspects to be tax avoidance - and you dont need to look far to find examples of these stories in national newspapers. In 2016 Google agreed to pay back 130m of tax dating back to 2005 to HMRC which said it was the full tax due in law.

HMRC define a tax avoidance scheme in the following way. Both tax evasion and some forms of tax avoidance can be viewed as forms of tax noncompliance. Our message is simple come forward and settle your affairs play by the rules or be caught and face the consequences.

HMRC is cracking down on evasion both domestically and offshore. If you are approached to take part in a tax avoidance scheme it is important to take proper professional advice and be aware that HMRC does. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B.

28 This government has made significant investments in HMRC to tackle evasion. This is not tax evasion or tax avoidance in HMRCs terms rather just paying the minimum allowable without breaking the law. On 16 Feb 2022.

Schemes HMRC has concerns about You can find examples of tax avoidance schemes HMRC is looking at closely. HMRC does not approve any tax avoidance schemes. Avoiding tax is legal but it is easy for the former to become the latter.

44 203 080 0871. Unsurprisingly this is an area where HMRC are making great strides with many new measures being introduced to help crackdown on tax evasion.

This Useful Infographic Shows The Impact Of Hmrc S New Real Time Information Rti Legislation And Three Key Steps You Shou Rti Inforgraphic Business Resources

National Insurance Company Jobs In 2021 National Insurance Company Job Insurance Company

Top 5 Tax Scandals World Finance

Tax Avoidance What Are The Rules Bbc News

Tax Avoidance And Evasion In Africa Roape

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

Hmrc Empowered To Name And Shame Tax Evasion Enablers Tax Avoidance The Guardian

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Hmrc Investigates 153 Enablers Of Tax Evasion Ftadviser Com

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Hmrc Investigates 153 Enablers Of Tax Evasion Ftadviser Com

John Wade On Twitter Read It And Weep Social Awareness Graphing

Tax Avoidance Vs Tax Evasion What S The Difference

The Twin Tax Headaches Hmrc Needs To Resolve

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership