san antonio general sales tax rate

2018 rates included for use while preparing your income tax deduction. Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825.

Texas Car Sales Tax Everything You Need To Know

Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

. Effective Tax Rates for General Constructing Contractings in San Antonio TX. These two tax rate components together provide for a total. This is the total of state county and city sales tax rates.

Gross Sales 2020 3rd Qtr Percent Change Use Tax Purchases Amount Subject to State Sales. Maintenance Operations MO and Debt Service. The average cumulative sales tax rate in San Antonio Texas is 822.

Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of. The City and Bexar County tax is in addition to the 6 percent rate imposed by the State of Texas which must be remitted separately to the State.

San antonio city council approved on Thursday the sale of five properties it owned in. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. The average cumulative sales tax rate in San Antonio Florida is 7.

General Information Letters and Private Letter Rulings. The City also collects 175 percent for Bexar County. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

STATE SALES AND USE TAX ANALYSIS QUARTERLY REPORT San Antonio MSA. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax rate 125 and in some case special rate 075. If you have questions about Local Sales and Use Tax rates or boundary information email TaxallocRevAcctcpatexasgov or call 800-531-5441 ext.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. 675 Is this data incorrect Download all Texas sales tax rates by zip code. The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the Convention Center expansion.

The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value. The San Antonio Texas general sales tax rate is 625. The average total salary of General Constructing Contractings in San Antonio TX is 29000year based on 17 tax returns from TurboTax customers who reported their occupation as general constructing contractings in San Antonio TX.

The San Antonio Texas sales tax is 625 the same as the Texas. Did South Dakota v. This is the total of state county and city sales tax rates.

The 78216 San Antonio Texas general sales tax rate is 825. What is the sales tax rate in San Antonio Florida. There are approximately 3897 people living in the San Antonio area.

Bexar Co Es Dis No 12. The County sales tax rate is. View the printable version of city rates PDF.

Which state has no sales tax. The minimum combined 2022 sales tax rate for San Antonio Florida is. This rate includes any state county city and local sales taxes.

The San Antonio sales tax rate is. The 78216 San Antonio Texas general sales tax rate is. The Florida sales tax rate is currently.

The San Antonio Texas general sales tax rate is 625. How do you figure out sales tax in San Antonio. 17 full-time salaries from 2019.

City Sales and Use Tax. Every 2018 combined rates mentioned above are the results of. San Antonio Mta Sales Tax.

San Antonio has parts of it located within Bexar County and Comal CountyWithin San Antonio there are around 82 zip codes with the most populous zip code being 78245As far as sales tax goes the zip code with the highest sales tax is 78201. You can find more tax rates and allowances for. The property tax rate for the City of San Antonio consists of two components.

The San Antonio sales tax rate is 125. The Texas sales tax rate is currently. For tax rates in other cities see Florida sales taxes by city and county.

The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in Bexar County and specifically San Antonio when combined with the base rate of sales and use tax in Texas is 825. This includes the rates on the state county city and special levels. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax rate 125 and in some case special rate 075.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Avalara provides supported pre-built integration. Bexar Co Es Dis No 12.

The minimum combined 2022 sales tax rate for San Antonio Texas is. This includes the rates on the state county city and special levels. 2020 rates included for use while preparing your income tax deduction.

Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district. City sales and use tax codes and rates.

Texas Comptroller of Public Accounts. The 78216 San Antonio Texas general sales tax rate is. Industry Outlets 2021 3rd Qtr Outlets 2020 3rd Qtr.

The zone was established in 2000 to. The Official Tax Rate. The San Antonio sales tax rate is.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. For the 10-year period through fiscal 2021 the citys general fund revenues grew by a property tax rate-adjusted CAGR of 4 equal to US. The County sales tax rate is.

The current total local sales tax rate in San Antonio NM is 63750. Download city rates XLSX. San Antonio is located within Pasco County FloridaWithin San Antonio there is 1 zip code with the most populous zip code being 33576The sales tax rate does not vary based on zip code.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The 78216 San Antonio Texas general sales tax rate is 825. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

There is no applicable city tax or special tax. San Antonio Sales Tax Rates for 2022. Did South Dakota v.

Known as The Last Frontier Alaska is the most tax-friendly state. Historical Sales Tax Rates for San Antonio. The San Antonio sales tax rate is 825.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. What is the sales tax rate in San Antonio Texas. The current total local sales tax rate in San Antonio TX is 8250.

Is San Antonio tax free. You can print a 7 sales tax table here. Arlingtons rate is even lower at 8 percent.

The December 2020 total local sales tax rate was also 8250. The December 2020 total local sales tax rate was also 63750.

Texas Sales Tax Guide And Calculator 2022 Taxjar

Worksheet For Completing The Sales And Use Tax Return Form 01 117

Sales Tax Rates In Major Cities Tax Data Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Sales Tax By State Is Saas Taxable Taxjar

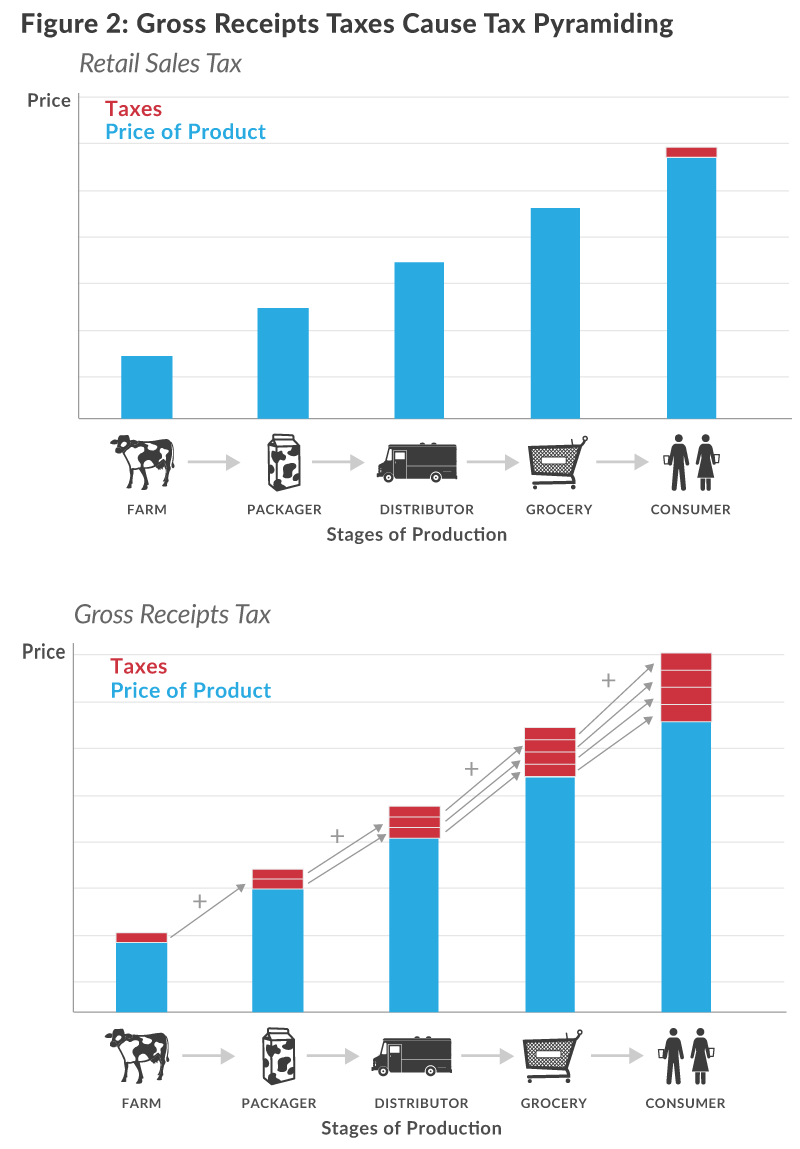

The Texas Margin Tax A Failed Experiment Tax Foundation

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Sales Tax By State Is Saas Taxable Taxjar

Craft Fairs And Sales Tax A State By State Guide

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Texas Sales Tax Guide For Businesses

Texans Pay 3 8 More In State Taxes Than Californians I Thought It Was A Low Tax State R Texas

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Rates By City County 2022

How To Calculate Sales Tax On Almost Anything You Buy

What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25